Examine This Report on Amur Capital Management Corporation

Examine This Report on Amur Capital Management Corporation

Blog Article

The 3-Minute Rule for Amur Capital Management Corporation

Table of ContentsThe smart Trick of Amur Capital Management Corporation That Nobody is Talking AboutAbout Amur Capital Management CorporationAmur Capital Management Corporation Things To Know Before You BuyThe 8-Second Trick For Amur Capital Management CorporationNot known Details About Amur Capital Management Corporation Some Of Amur Capital Management Corporation

The firms we comply with require a strong record normally a minimum of 10 years of operating history. This suggests that the firm is most likely to have faced at the very least one economic slump which management has experience with adversity in addition to success. We look for to omit firms that have a credit rating high quality below financial investment grade and weak nancial strength.A firm's capacity to elevate dividends regularly can show protability. Business that have excess cash ow and solid nancial settings typically choose to pay dividends to draw in and compensate their shareholders. As a result, they're frequently less unpredictable than stocks that do not pay rewards. But beware of grabbing high yields.

Excitement About Amur Capital Management Corporation

We've located these supplies are most at threat of cutting their rewards. Expanding your investment profile can aid shield against market uctuation. Check out the following variables as you prepare to expand: Your profile's asset class mix is among the most important aspects in establishing performance. Look at the size of a business (or its market capitalization) and its geographical market U.S., industrialized global or arising market.

Regardless of just how very easy electronic investment monitoring systems have actually made investing, it should not be something you do on an impulse. As a matter of fact, if you decide to get in the investing world, something to consider is for how long you actually want to invest for, and whether you're prepared to be in it for the long haul.

There's an expression common associated with investing which goes something along the lines of: 'the round may drop, but you'll want to make certain you're there for the bounce'. Market volatility, when economic markets are going up and down, is a typical sensation, and long-term could be something to help ravel market bumps.

What Does Amur Capital Management Corporation Do?

Keeping that in mind, having a long-term approach could aid you to benefit from the wonders of compound returns. Joe invests 10,000 and gains 5% dividend on this financial investment. In year one, Joe makes 500, which is repaid right into his fund. In year 2, Joe makes a return of 525, since not just has he made a return on his first 10,000, but likewise on the 500 spent dividend he has gained in the previous year.

More About Amur Capital Management Corporation

One means you can do this is by taking out a Supplies and Shares ISA. With a Supplies and Shares ISA. passive income, you can spend as much as 20,000 annually in 2024/25 (though this goes through alter in future years), and you do not pay tax on any returns you make

Getting started with an ISA is really simple. With robo-investing systems, like Wealthify, the effort is done for you and all you need to do is pick just how much to spend and pick the danger degree that matches you. It may be one of minority circumstances in life where a less emotional strategy could be helpful, however when it involves your finances, you could wish to pay attention to you head and not your heart.

Staying concentrated on your long-term objectives might help you to avoid unreasonable decisions based on your feelings at the time of a market dip. The stats do not exist, and long-term investing can come with several benefits. With a composed method and a lasting financial investment technique, you could possibly grow even the smallest quantity of savings into a suitable amount of money. The tax treatment relies on your private situations and might be subject to transform in the future.

The Buzz on Amur Capital Management Corporation

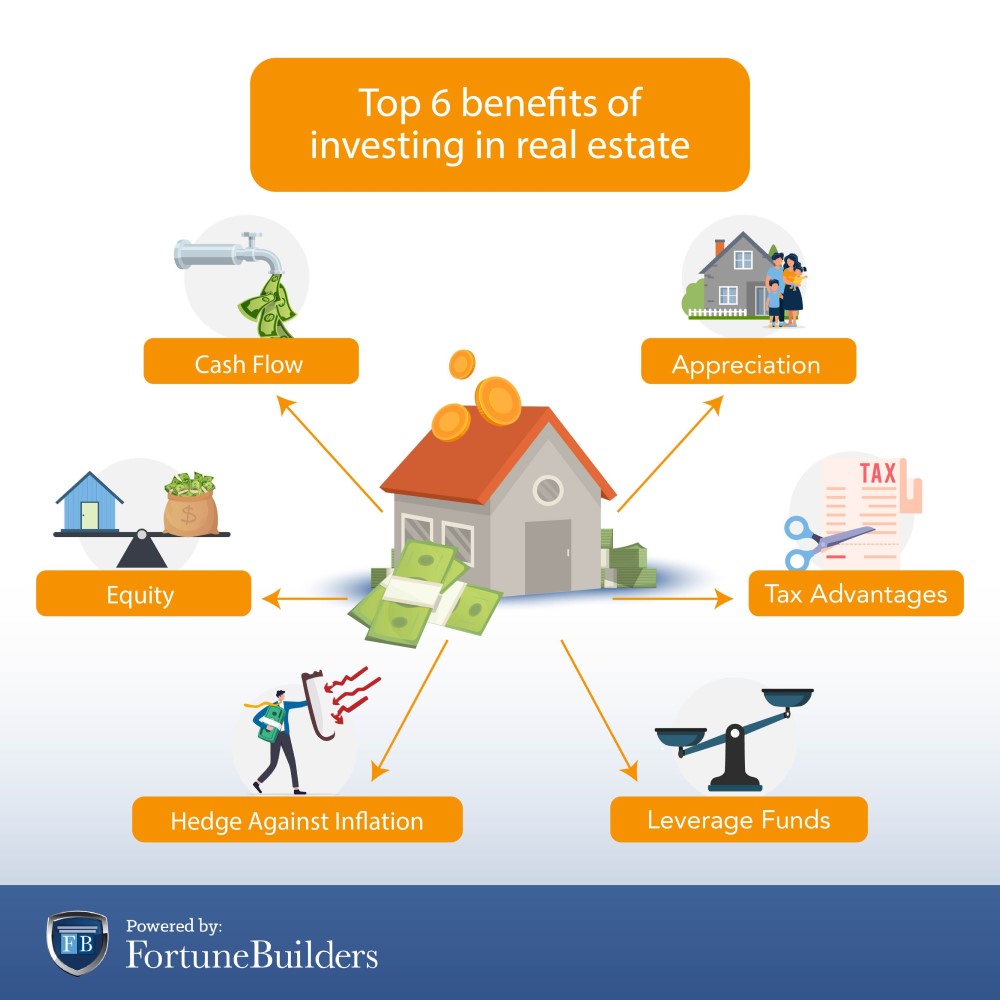

Spending goes one action better, helping you attain individual objectives with three substantial advantages. While conserving methods alloting part of today's money for tomorrow, investing means placing your cash to work to possibly earn a better return over the longer term - passive income. https://amurcapitalmc.edublogs.org/2024/04/06/unlocking-investment-potential-amur-capital-management-corporation/. Different classes of investment assets cash, repaired my site interest, home and shares normally create various levels of return (which is about the threat of the financial investment)

As you can see 'Growth' possessions, such as shares and property, have actually historically had the most effective total returns of all property courses but have actually additionally had bigger tops and troughs. As a financier, there is the potential to earn resources development over the longer term as well as an ongoing income return (like returns from shares or rent from a property).

Amur Capital Management Corporation Things To Know Before You Get This

Rising cost of living is the ongoing surge in the expense of living over time, and it can effect on our financial health and wellbeing. One means to help outpace inflation - and generate favorable 'real' returns over the longer term - is by spending in possessions that are not simply with the ability of delivering greater income returns however additionally use the capacity for funding growth.

Report this page